Customer segmentation is the process of analyzing customer features (such as age, education, interests and spending habits) and creating groups (called segments) that share interests in specific products or services.

In this way, customer segmentation enables companies to find the most appropriate customers for their purposes and invest their resources more beneficially. Moreover, it is an economical and fast way to increase customers and effectively manage existing ones.

It has been proved that artificial intelligence can select potential clients much better than traditional methods. These operations are very useful in the marketing ambit, so they can determine with considerable accuracy which of these customers are promising candidates for a specific marketing campaign.

Data set

In this real case customer´s case the data set contained 1,000,000 clients with 500 features, including:

- Personal Variables: Sex, age, nationality…

- Account Variables: Account balance, credit card debt…

- Product Variables: Home mortage, car leasing…

- Insurance Variables: Life insurance, Home insurance…

- Transaction variables: Cash point usage, Web site usage…

- Success: 1 if the purchase was made in the previous campaign made by bank, 0 otherwise

Our target variable was a success, as it is what our customers wanted to improve. Before contacting us, they had a success rate of 1%.

Using artificial intelligence techniques such as artificial neural networks, our team studied the data to see how the success rate could increase.

Purchasing factors

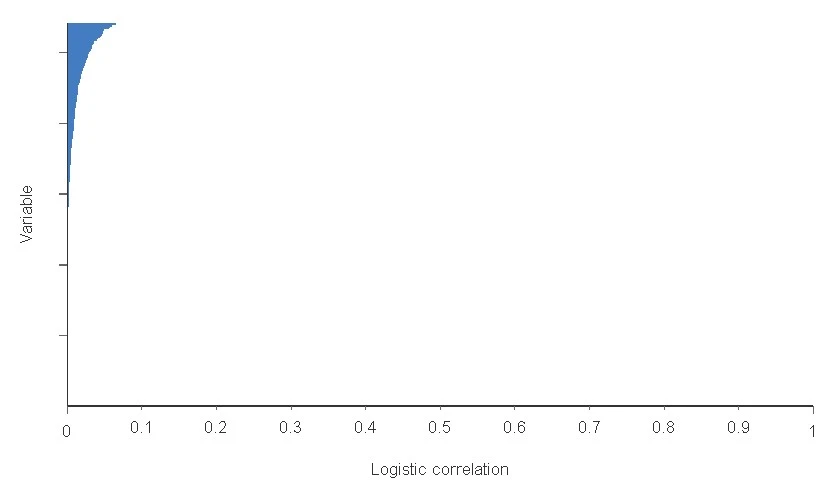

After studying the correlations between the variables, we realized that all the variables had a very low correlation (under 10%). This indicates that individually there is no one that significantly influences the purchase of products, so we can say that the problem is complex, and various factors influence the purchasing process.

The variables with the highest correlation are the number of services with the entity, the number of cash point operations during the last month and whether the customer had life insurance.

The factors that most influence the purchase process are those related to engagement.

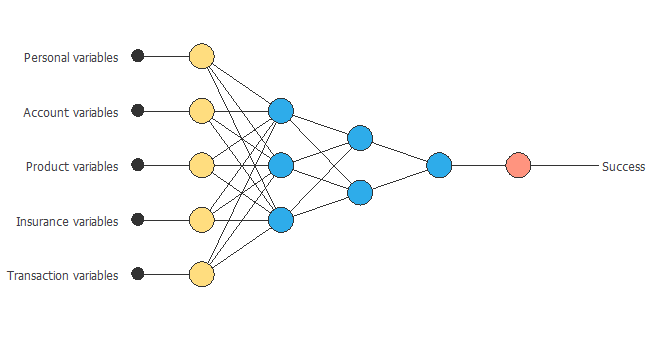

Neural Network

After studying all these factors, we used artificial neural networks to build a predictive model to analyze every variable and select the best target for the telemarketing campaign.

That study concluded that the conversion rates could be increased from 1% to 2.5% by selecting the proper target. This is a very significant increase since, without using the model, we got one customer out of every 100 contacts, whereas now we have one conversion for every 40 contacts.

Conclusions

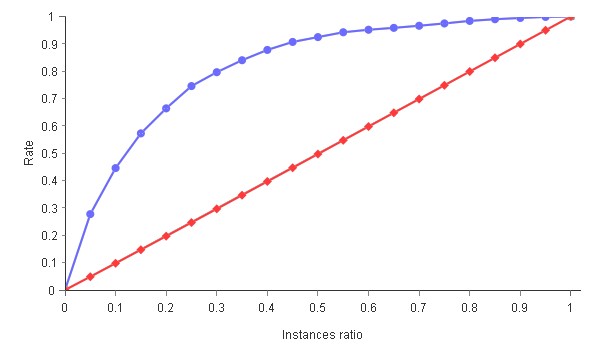

By analyzing the cumulative gain obtained with the predictive model, we can see that by contacting 30% of the most likely customers, the bank would achieve 80% of the total sales.

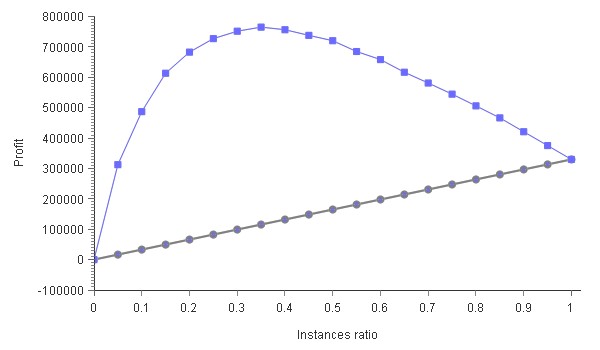

Finally, after knowing the precision with which we identify customers, it is essential to understand how this would affect our benefits.

We will assume that the unit cost per contact with each potential customer is € 5 and that the unit benefits if they buy the product is € 1,000. The following graph shows how the benefit would behave if we did not apply the predictive model (grey line) and how it would apply if we used it (purple line).

As we can see, the maximum benefit is produced by contacting the 35% of customers with the most purchase probability. This benefit would be € 750,000, while without using the predictive model would be € 125,000.

The use of new methods and tools for advanced analytics provides a great advantage for Business Intelligence Departments, which translates into a greater benefit for the bank.